The Supreme Court Strikes Down IEEPA Tariffs

On Friday, February 20, 2026, in a 6 to 3 decision, the Supreme Court held in the case of Learning Resources/V.O.S. Selections that President Trump DOES NOT have the authority to impose tariffs under the International Emergency Economic Powers Act (IEEPA).

At a press conference following the Court's decision, President Trump announced that "effective immediately," he will impose 10% global tariff under Section 122, and the Administration will initiate several 301 investigations. The RV Industry Association will provide updates on these actions as they become available.

Of note, the Court did not weigh in on whether or how the federal government should provide refunds to importers who have paid the tariffs, instead leaving it to the US Court of International Trade.

The Majority Opinion

IEEPA is a United States federal law authorizing the president to regulate international commerce after declaring a national emergency in response to any “unusual and extraordinary threat” to the United States. A separate provision of the law states that when there is a national emergency, the president may “regulate...importation or exportation” of “property in which any foreign country or a national thereof has any interest.”

The majority opinion, written by Chief Justice Roberts, focused on that second provision, determining that “regulate” and “importation” do not grant the President “independent power to impose tariffs on imports from any country, of any product, at any rate, for any amount of time.” The opinion also noted that IEEPA contains no references to tariffs or duties, and no President has ever read it to grant such power. The decision reshapes the balance of power between the president and Congress over trade and emergency powers, clarifying that a president may not unilaterally determine tariff policy to this extent under this law.

President Trump’s Options Moving Forward

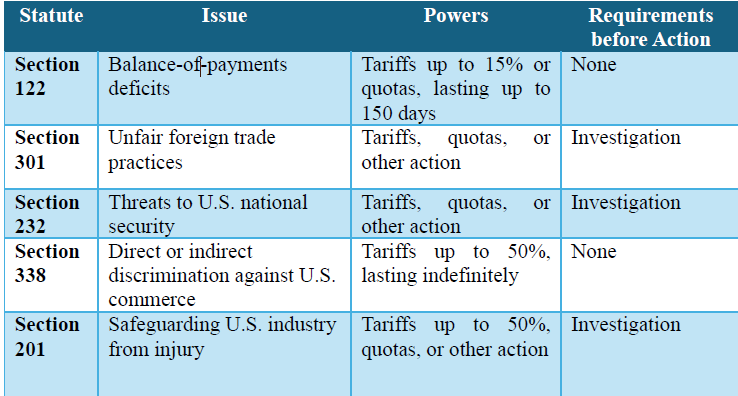

The President has been adamant that tariffs will remain a central part of his economic policy and the administration has said they have plans to impose tariffs utilizing other authorities. Justice Kavanaugh’s dissent, likewise, states that “numerous other federal statutes authorize the President to impose tariffs and might justify most (if not all) of the tariffs at issue in this case—albeit perhaps with a few additional procedural steps[.] Those statutes include, for example, the Trade Expansion Act of 1962 (Section 232); the Trade Act of 1974 (Sections 122, 201, and 301); and the Tariff Act of 1930 (Section 338).”

However, those statutes are more limited in their authority. For example, Section 122 allows the president to impose tariffs but limited to 15% and only up to 150 days. Section 301 requires an investigation by the Commerce Department and US Trade Representative.

The RV Industry Association team is working with our trade partners to review the decision and will update members with additional information as we receive it.

To read the Supreme Court Opinion, click here.

For a detailed breakdown of the decision, click here.

Please contact RV Industry Association Director of Federal Affairs Samantha Rocci at srocci@rvia.org with any questions, and keep up with the latest tariff updates here.

Please Sign in to View

Log in to view member-only content.

If you believe you are receiving this message in error contact us at memberservices@rvia.org.