Trends In RV Ownership, Part 1

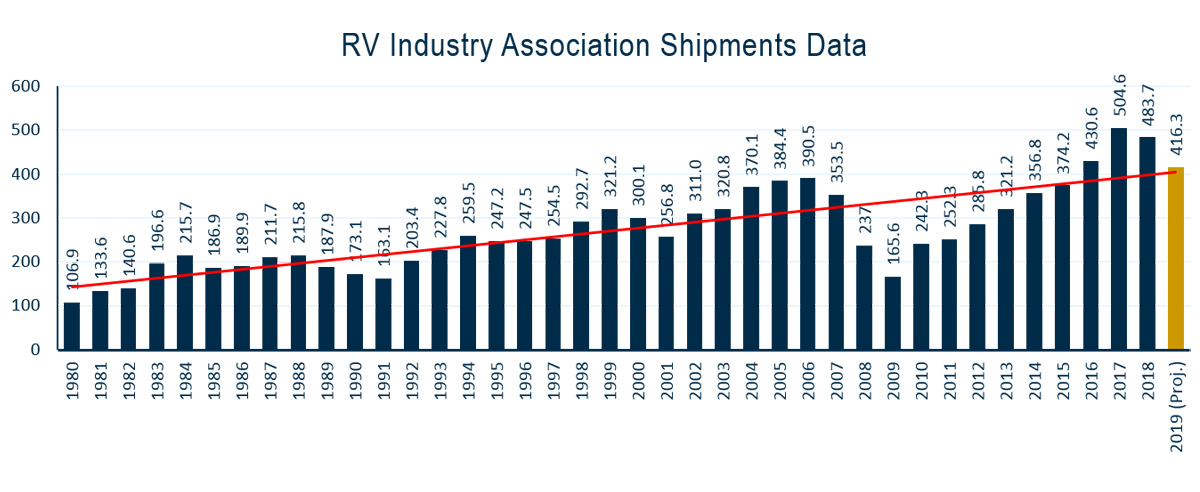

The 2018 RV Industry Profile is now available! 2018 saw RV wholesale shipments slip from a record-year of 504,600 units in 2017 to 483,700 units, still a remarkable total that is second-highest on comparable record. It marked the first time since 2009 that the RV market declined year-over-year. In that span, the RV industry saw its longest period of sustained growth, climbing from 165,700 units in 2009 to 504,600 nine years later, an incredible increase of 204.5%.

In examining the record of RV wholesale shipments back to the 1980, the annual totals rise to peaks for several years then fall briefly to valleys before beginning the next climb. But over this 38-year historical record the trend line is persistently ascending. In the midst of the shorter cycles between highs and lows, RV consumers and their purchasing decisions are being impacted by many dynamics – the stage of their life, personal financial situations and outside economic factors, such as wages, interest rates, employment, and a host of other influences. When viewed in total, the continuous climb to higher wholesale shipment totals over the long term is evidence of the deeply held, aspirational preference consumers have for RV travel and camping. RV ownership provides consumers with the ability to travel when and where they want, to spend time outdoors pursuing their favorite activities and most importantly, to connect deeply with family and friends. It is this strong preference consumers have for RV travel and camping that bodes well for the industry in the future.

The RV industry will also be boosted by a diverse market of consumers that includes Baby Boomers, Generation X and Millennials reaching ages that traditionally have the highest rates of RV ownership. Baby Boomers have driven the RV industry expansion since the 1990s. Over the coming years, RV sales will continue to benefit from this generation as well as Millennials. And those two groups represent a substantial amount of potential customers. The number of consumers between the ages of 55 and 74 will total 79 million by 2025, 15 percent higher than in 2015, and the number between age 30 and 45 will total 72 million by 2025, 13 percent higher than in 2015.

The impact of younger buyers on the RV market is already being seen as they helped drive the most recent expansion of the RV market. Data from Statistical Surveys, Inc. collected on RV retail registrations found that from 2015-2018, the share of RV ownership by age range increased in the younger age brackets while rates remained level or decreased somewhat in older age ranges. The share of RV ownership for those aged 35-44 increased from 18.42 percent in 2015 to 20.75 percent in 2018. For those aged 25-34, it rose from 5.03 percent to 8.10 percent. Even the youngest age range of 18-24 saw a gain of 0.15 percent to 0.37 percent. For those in the 45-54 and 55-64 age ranges, the ownership level held steady: while it dropped slightly for those age 65-74.

Read part two on how the younger generation is driving growth in the RV lifestyle, here!

Please Sign in to View

Log in to view member-only content.

If you believe you are receiving this message in error contact us at memberservices@rvia.org.